The hardest thing in the world to understand is income tax – Albert Einstein

When you have serious money, you need help developing a comprehensive tax strategy. You’ve got a lot to lose if not done right.

One way to improve net returns is to reduce your taxes. What if you had a tax professional on your team who could work closely with your financial advisor to make the most of your tax plan as well as your overall financial plan.

At Compass Wealth, our sister company, Chapman & Co., P.C., provides a complete array of tax services tailored specifically for your needs. Understanding tax law, staying current on changes, and finding opportunities to minimize taxes takes a full-time commitment from a team of experienced professionals.

We are always tax-conscientious and use tax minimization strategies based on best practices in the industry. We make sure you understand your choices and then help you implement those strategies. We take a very proactive approach, which means thinking ahead about what may happen today that can affect tomorrow’s outcome. Waiting too long to act can put your wealth at risk.

Whether you need our help for personal or business taxes, we have an effective strategy that can help improve your returns and save you money.

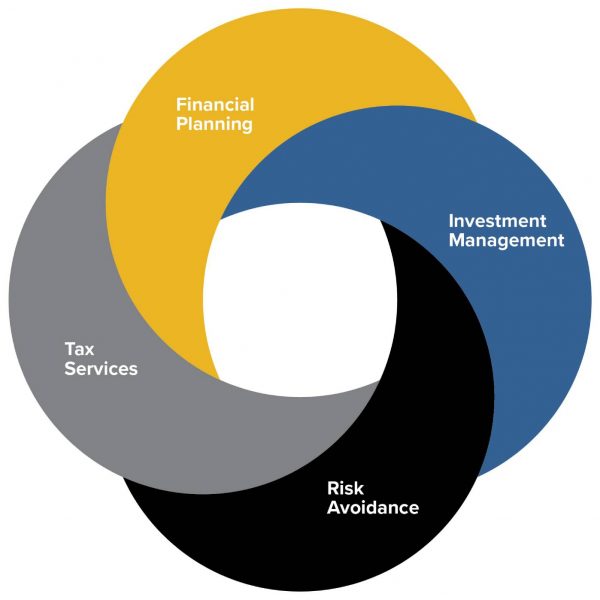

We integrate your tax planning with your general financial planning to make sure that you’re reaping the benefits of a comprehensive financial planning approach without oversight or missed opportunities.

- Your tax planning decisions impact the investment advice we give you, so a holistic approach will help set you up for success in all areas of your financial life: We consider the true wealth impact of tax deferral and gains harvesting on your investments

- We will coordinate all investment-related issues to avoid any unnecessary surprises

- We will strive to avoid unnecessary worries or unexpected negative surprises

Ultimately, we’re here to save you money and time, and we even go the extra step of making sure any changes align with the rest of your financial life.